A Conversation between Tekoa DaSilva and Jim Rickards

(dan komentar EOWI)

Beberapa waktu lalu seorang pembaca EOWI menyebutkan nama Jim

Rickard, dan menanyakan apakah EOWI pernah membaca bukunya yang berjudul

“Currency War”, serta apakah posisi EOWI berada pada kubu yang sama dengan Jim

Rickard.

Nama Jim Rickard, saat ini menjadi celebrity di dunia

investment. Beberapa bukunya menjadi best sellers. Dan istilah currency war menjadi sangat popular dan

menjadi jargon di kalangan dunia investasi.

Saya coba untuk membaca 2 bukunya, Currency Wars dan The Death

of Money. Tetapi baru beberapa bab, saya menjadi bosan dan kehilangan rasa

ketertarikan. Penyebabnya adalah basis/dasar dari kisah yang ditulis Jim

Rickard yaitu teori konspirasi. Saya tidak terlalu percaya terhadap teori

konspirasi. Yang kedua, adalah adanya promosi dirinya sebagai pakar di bidang

segala macam tetek-bengek yang ada di

teori konspirasi di atas.

Saat ini Jim Rickard bekerja sebagai editor salah satu economic news letter yang diterbitkan

oleh Agora Financial. Ia mempromosikan teknik yang dikatakannya sangat ampuh

benama “Impact System”, sistem yang

ciptakan untuk CIA.

Kita ikuti saja tulisan yang saya copy dari DailyReckoning.com.

Tekoa Da Silva: Jim, you are

the author of New York Times best-seller, The Death of Money. In reviewing your

work, I see a lot of events surfacing in the world that you seem to have

foreshadowed in your writings.

I’d

like to ask you about those items, but for the person joining us for the first

time, can you tell us a little bit about your professional background -- how

you went from working in the legal profession to now being a financial and

global economic expert?

Jim Rickards: Sure Tekoa.

Well, at this point, the resume is kind of a long one. So, I won’t kind of go

through every twist and turn. I am a lawyer by training. But before I went to

law school, I got a graduate degree in International Economics from the School of Advanced International Studies. Tim

Geithner was one of my fellow alumni from SAIS

-- the School of Advanced International Studies. It’s

well-known as the intellectual training ground for the IMF. It’s a school where

a lot of people go if you want to work for the IMF.

They

take a lot of graduates and professors at SAIS

as IMF officials who come over because they’re all in Washington, D.C.

The IMF is right around the corner, just a few blocks from the school, and so

they have IMF officials come in as adjunct. So it’s an intellectual symbiosis

between the School

of Advanced International Studies

and the IMF and that is where I went to graduate school in economics.

Now

interestingly, my class was the last class to be taught about gold as a

monetary asset. I graduated in 1974. A lot of people think the world went off

the gold standard in 1971 when Nixon gave his famous speech but that’s not

quite correct.

If

you listen to what Nixon actually said (interested viewers can find the video

on YouTube), he didn’t say we’re going off the gold standard. He said, “I am

temporarily suspending redemption of dollars for gold and the ability of our

trading partners to take their dollars and cash them in for gold.”

But

he used the word “temporary” and I recently had an occasion to speak to Paul

Volcker about it because Paul was one of the people in the room when that

happened. There was a small group that went up to Camp

David. There was President Nixon, John Connolly, Secretary of the

Treasury, Arthur Burns, Chairman of the Federal Reserve, Paul Volcker who was

Deputy Secretary of the Treasury and actually another friend of mine, Ken Dam.

Ken very kindly offered a jacket commentary in The Death of Money but people

who don’t know Ken should know that he was at Camp David

that weekend.

But

what Nixon actually said -- and Paul Volcker confirmed this when I spoke to him

-- is that they didn’t think they were going off the gold standard. They

thought they were calling a time-out. They thought this was a temporary

suspension until the major global powers could get together and come up with

new ‘rules of the game,’ kind of rewrite the system and that they might get

back to a gold standard.

Now

it would have been at a different gold price. Clearly, the dollar needed to be

devalued and that’s actually what happened in December. So the Nixon speech was

August ’71. December ’71 was the Smithsonian Agreement and at that time, the

dollar was devalued. The official price of gold was raised to about $42 an

ounce from $35 an ounce. So that was a 20% devaluation of the dollar and we

were still on the gold standard at the time. But you still couldn’t redeem.

So

the joke about US

policy was -- instead of not selling you gold at $35, we won’t sell it to you

at $42.

So

the joke about US

policy was -- instead of not selling you gold at $35, we won’t sell it to you

at $42. The US

wasn’t redeeming either way, but officially the price had gone up and we kind

of fumbled and stumbled our way through the next three or four years. There

were a series of International Monetary conferences conducted, studies, and

working groups under the auspices of the IMF. The world wasn’t sure -- would

they go back to fixed exchange rates? Would they move to floating exchange

ranges? Would you have sort of dirty floats and pegs? Would there be a gold

standard? Would there not be a gold standard?

That

was all unclear until 1975 when the IMF finally broke the link to gold and

demonetized gold. Well, my year was 1974. So I actually studied gold when it

was still a monetary asset and I was a 25-year-old grad student in economics.

But my professors were people in their 50s or older who were the young guns in

the early 1950s at the origin of the IMF.

So

I was being taught by people who ran the Bretton Woods system in the 1950s and

1960s as scholars and technical analysts, and they were my professors. So I

would say anyone who is younger than I am who knows anything about gold is

either self-taught or they went to mining college, because it literally stopped

being taught in 1974, 1975.

So

part of what I try to do in my books is to reintroduce some of that education.

But then I went to law school. I started my career at Citibank. I was there for

about 10 years. I worked for one of the primary dealers in US government

securities.

Today

it has been bought by larger banks but it’s now part of RBS -- Royal Bank of Scotland. My

old firm is now the primary dealer in RBS. Then I worked famously at Long Term

Capital Management, the hedge fund. I did a few other things: worked for Bruce

Kovner at Caxton and became an author and also after 9/11, an adviser on

financial threats and financial warfare to the US intelligence community.

So

a little bit of an eclectic career, but my books, Currency Wars and The Death

of Money, are a good chance to bring a lot of that perspective and knowledge

and learning experience to an older audience who cares about their net worth

and a younger audience who have not studied a lot of these things. So people in

their 20s and 30s, all this happened before their time, but they can read the

books and get some of that flavor.

Tekoa Da Silva: Jim, the price

of gold as of late has been weak. That weakness was pronounced following an

announcement from the People’s Bank of China that their exchange reserves

holdings were lower than the investment community was expecting. What were your

thoughts when you saw that release come out?

Jim Rickards: Well, a

couple of things. First of all, I did predict this in my book. The Death of

Money came out in 2014 but of course I was writing it in 2013. It was published

in 2014. But in the book I said that the Chinese would likely update their gold

reserves in 2015 which is exactly what has happened because they’re on a sort

of six-year tempo. They did it in 2003, then six years of radio silence. They

updated in 2009.

Six

more years of radio silence. They updated it in 2015. So there’s kind of a

precedent, and they don’t like to break the mold so to speak. But I don’t know

if it will be another six years next time.

The

Chinese are trying to play nice with the IMF because they want the yuan

included in the basket of currencies that’s used to determine the value of the

world money

The

Chinese are trying to play nice with the IMF because they want the yuan, their

currency, included in the basket of currencies that’s used to determine the

value of the world money, which is the special drawing right, or the SDR,

that’s printed by the IMF.

So

China

wants to get into that club. But by joining any club, you have to play by the

rules. The club says wear a suit and tie -- you wear a suit and tie. And in

this case, the IMF club says you have to be a little bit more transparent.

China

is doing this in an effort to be transparent, so they may update their gold

reserves more frequently than this six-year tempo I just described as a way of

showing the IMF that they’re ready to be fully or at least partially

transparent members in the International Monetary System.

Having

said that, the 604-ton update was China going from 1054 tons, which

was a lie, to 1658 tons which was another lie, but they’ve updated the lie.

When I say lie, I mean they’re not transparent and this is also explained in my

book The Death of Money. They have three sovereign wealth funds or government

entities, government portfolios if you will. One is the People’s Bank of China.

Komentar EOWI: Cina mungkin tidak

transparan untuk cadangan emasnya. Yang sebenarnya, tidak ada kewajiban Cina

untuk melaporkan isi perutnya kepada

publik. Demikian juga US, apakah the Fed transparan dengan cadangan emasnya?

Cina tidak hanya menumpuk emas, tetapi juga

tembaga, dan logam-logam lainnya. Dengan adanya surplus perdagangan dan

kebanjiran US dollar, tidak terlalu mengherankan jika Cina melakukan

diversifikasi assetnya ke asset-asset yang tangible.

Bahwa kemudian penumpukan asset-asset tangible oleh Cina membuat sektor ini

berubah menjadi bubble, itu persoalan

lain yang harus dihadapi para pemain di sektor ini.

Suatu hal yang bisa dicatat, biasanya jika

pemerintah/bank sentral mulai masuk dan ikut berspekulasi, maka kejadian

tersebut bisa dijadikan sebagai indikator akhir dari bubble. Dan bubble tidak

mengempis, tetapi meledak.

So

that’s the one that updated the reserve position and reported the 604

additional tons of gold. But the other one is CIC, China Investment

Corporation, which is a sovereign wealth fund, and the third is the most

mysterious and biggest of all, which is SAFE. SAFE stands for State

Administration on Foreign Exchange and what they do buy the gold and then every

now and then for bookkeeping entry, they flip it over to the People’s Bank of

China and then the People’s Bank of China updates their reserve balances.

So

I’m not saying the People’s Bank of China is lying about their gold. That is

how much gold they have. But whether to ignore how much gold that SAFE has off

the books is the question. I think it’s reasonable to estimate at least 3000

tons, maybe more. There’s reason to think it could be more. How do we know

that? I mean I’m not just guessing by the way. We know mining output is about

450 tons a year; it has been for a number of years.

We

know Hong Kong imports run between 700-1000

tons a year. So just combine those two sources. But let’s just say there’s

about 1300 tons a year between Hong Kong

imports and mining output that we know about.

Now

I also know, because I’ve been in China and spoken to secure logistics people,

that some gold is being brought in completely off the books; actually over land

using People’s Liberation Army assets, probably coming in from Kazakhstan,

maybe Russia. The source is not clear but there’s some additional gold coming

in. But let’s just take what we know about it without speculating too much. So

let’s say there’s about 1300 tons of gold coming in. This has been going on for

five years. So that’s 6500 tons of gold that we know about, not counting what

we don’t know about.

Now,

what we don’t know is how much of that gold is going into private hands and how

much is going to the government. For the People’s Bank of China, it’s unclear.

I assume 50-50. I could be wrong. But in the absence of better information,

that’s a good first estimate. So it looks like 6500-plus tons have come in and

assuming 50% of that is going to the government -- there’s over 3000 tons the

government added that the People’s Bank of China has not reported. They just

park it in SAFE in the meantime.

So

we can be certain China

has a lot more gold. But if the price of gold went down because people were

expecting China’s

reserves to be a lot higher and they turned out to be less -- then I cannot

dispute the price. But that’s no reason to mark down the price of gold, because

China

does have a lot more gold and we know it.

The

declining price of gold by the way is apparent if you make the dollar the

measure of all value. When people say gold went down, I say, “Well no, it

didn’t. Gold is just gold. It just sits there.” So if you say the dollar is the

measure of all value, then yes, gold went down.

Komentar EOWI: Jatuhnya harga emas dan

komoditi lainnya adalah akhir dari bubble

di sektor komoditi dan emas yang berlangsung dari tahun 2000 – 2011. Pemerintah

Cina mau borong emas, mencoba meniup untuk menggembungkan kembali sektor

komoditi dan emas, tetapi kekuatan pasar lebih besar. Itu sebabnya harga emas

jatuh bersama komoditi.

Seperti halnya bank-bank sentral Eropa yang

menjuali emasnya, Bank of England di tahun 1999 – 2002, National Bank of Swiss

tahun 2000 – 2005 tidak membuat harga emas tertekan, malah sebaliknya.

But

if you make gold the measure of value, to me what really happened is the dollar

went up. In other words, the low dollar price of gold is really a strong dollar

phenomenon more so than a weak gold phenomenon. You get more gold for your

dollar. So you can say gold went down but it is equally logical to say the

dollar went up. We have a stronger dollar.

Komentar EOWI: Pertanyaannya

yang seharusnya dilontarkan juga adalah: kenapa US dollar menguat?

Basis kepercayaan EOWI, penguatan US dollar

adalah karena monetary deflation dari US dollar. Spekulan dan investor keluar

dari komoditi dan mencari safe heaven

di US dollar.

So

that’s how I view it and my basis is that gold is not the only thing that has a

lower dollar price by weight. Copper, wheat, corn, steel, lumber, and iron ore

all do. Look at commodities around the world. Look at all the other currencies,

Australian dollar, Canadian dollar, and Japanese yen.

Every

one of them is “down,” if you will, against the dollar. What’s the common

denominator? It’s not that the price is down. It’s that the dollar is up. We’re

living in a world of king dollars.

But

what is that? That’s the definition of deflation. When you get more for your

money, when the dollar is worth more, and goods in dollar terms cost less, that

is what deflation is.

But

think about it from the Central Bank and Janet Yellen’s point of view. She

wants inflation. She told us that. It’s not a secret. She publicly states that

she wants inflation. We’re getting deflation. She’s threatening to raise

interest rates which should add more deflation. So how does that work?

The

answer is that it doesn’t work. I said last year that the Fed would not raise

interest rates in 2015, and I think we’re going to get to 2016 and they still

won’t be able to raise interest rates because of the power of deflation.

So

I look at the commodities complex now including gold, and what I see is not

that the prices are down, although nominally they are. To me, it’s a strong

dollar story which is not sustainable, because the strong dollar is killing the

US

economy.

Komentar EOWI: Bukan membunuh ekonomi

US tetapi memaksa semua negara menata ekonominya kembali. Periode deflasi akan melahirkan teknologi

baru, cara baru dalam menghasilkan jasa dan barang, kebiasaan dan model bisnis baru

yang lebih effisien dan kompetitif. Contohnya adalah untuk sektor retail ada toko

online, untuk transportasi ada taxi online Uber dan Gojek, untuk sektor hotel

ada AirBnB, dan untuk perpustakaan ada Google, dan dimasa mendatang adan muncul

model-model bisnis lainnya yang akan mengancam model bisnis lama. Bisnis yang

tidak effisien dan tidak bisa bersaing akan mati.

TD: Jim, in The Death of Money, you

spoke about the channels of passage that the People’s Bank of China needs to

use in order to accumulate their gold position, in that the pricing environment

is sensitive to a larger picture of global currency rearrangement. Some might

suggest manipulation goes hand in hand with that. What are your thoughts?

Komentar EOWI: Seharusnya pertanyaannya

adalah: Kenapa Cina perlu mengumpulkan emas. Seandainya memang perlu, kapan

waktunya?

Bank of England melepas banyak cadangan

emasnya tahun 1999 - 2002. Sebanyak 395 ton terjual dengan harga rata-rata US$

275 per oz. Antara tahun 2000 - 2005, National Bank of Switzerland menjual 1,300

tonn emas dengan harga rata-rata US$ 350 per oz. Banyak bank-bank sentral lainnya juga melepas

cadangan emasnya dengan sebab-sebab tertentu.

JR: Well, you can call it

manipulation (and it is in a way) but it’s also policy. Countries are very

powerful. Countries have interest rate policies, foreign exchange policies, tax

policies and they have a view on gold. They don’t talk about it, and again you

can say it’s manipulation, but it’s really just the countries implementing

their individual policies. Now China’s

view of gold is fairly straightforward. They have $4 trillion equivalent in

reserves. The vast majority of that is denominated in US dollars.

Some

of it is gold. Some of it is euros. Some of it is other things. But the vast

majority of it is US dollars. The vast majority of those US dollars are in US

government securities. So when people say China wants to get rid of the

dollar as a global reserve currency, that’s nonsense. The dollar has no greater

friend. China

wants a strong dollar because they own so many of them. If you had $4 trillion,

you would want a strong dollar too.

The

problem is the United States

doesn’t want a strong dollar, but we’re getting one right now. I call this

“Mick Jagger economics” (of the Rolling Stones), where, “You Can’t Always Get

What You Want.” The Fed wants inflation but can’t get it for the time being.

They will get it eventually but it’s going to take longer than they thought.

But

in the meantime, China

wants a strong dollar because they own so many and a weak yuan because that

helps their exports. The US

wants a weaker dollar to encourage inflation but we’re not getting it. So

that’s going to tell us something about the future of Fed policy. But China fears that the US will ultimately be successful in

getting inflation.

They

believe the Fed will eventually get the inflation it wants. That’s going to

reduce the value of their dollar assets. If you inflate the dollar by 10% -- 2%

per year for five years -- that’s a little over 10% with compounding. If China has $4 trillion and you devalue that by

10%, you’re moving $400 billion of wealth from China

to the US

because the debt we owe them is worth less and we can pay it off in cheaper

dollars.

So

they’re worried about that and they’re vulnerable. People say, “Oh, they’re

going to dump US Treasuries.” No, that’s nonsense also. They’re not going to do

that. They couldn’t. First of all, the market is not that big. The US Treasury

market is a deep liquid market but it’s not that deep. It’s not that liquid.

There’s

no way China

could offload a lot of treasury securities without it immediately coming to the

world’s notice. If it became malicious, a form of financial threat, the president

could stop it by executive order. But why would China do that? It would be

devaluing their number one asset. It’s like setting your own house on fire.

They wouldn’t want to do that.

But

they can do something else. At the margin, as they acquire additional reserves

through exports, through their current account surplus instead of buying more

dollars, they can buy gold and that’s exactly what they’re doing.

They’ve

got this big pile of dollars and they’re worried about the dollar being

devalued. So what they’re doing is acquiring a big pile of gold.

They’ve

got this big pile of dollars and they’re worried about the dollar being

devalued. So what they’re doing is acquiring a big pile of gold. So now when

you have dollars and gold, you have a hedge position. If the dollar remains

strong or gets stronger, the gold is not going to do very much.

But

if we do get inflation and devalue the dollar, they’re going to gain on the

gold because obviously gold will go up with inflation. The Chinese are not

stupid. They’re not speculators. They’re hedging the dollars. One of them is

always going to win.

So

they need to buy more gold, and also, a lot of gold investors say China is going

to bash the dollar and come out with a gold-backed currency and the price of

gold is going to go to the moon. Also nonsense. China doesn’t want that. As I

explained, they want a strong dollar, and for now, they need to buy more gold.

If you needed to buy gold, would you want a high price or a low price? You

would want a low price because you’re still buying.

Since

they’re still acquiring, they want a cheap price of gold. So there are a lot of

forces at play in the world. There are also people who think the Chinese are

naively trying to destroy the dollar or naively trying to help gold investors,

but no, China is out to help

China.

They’re not out to help you. They’re not out to help me. They’re not out to

help gold. They’re out to help themselves.

What

that means is they have to acquire a lot of physical gold. And what’s

interesting about that, as we all know, is there’s not that much physical gold

around. So I personally like to buy physical gold. I think when the system

breaks down (which I do expect) and the price of gold begins to skyrocket,

people will say, “Oh, I will go out and get my gold then.” Guess what. You may

not be able to find it. The time to get your gold is now.

Komentar EOWI: Memang tidak banyak emas

beredar, tetapi lebih langka lagi harimau Sumatera. Kenapa orang harus lari ke

emas ketika ada krisis? Kenapa tidak ke berlian, atau harimau Sumatera? Apa

yang membuat orang terpaksa lari ke emas?

Pada masa krisis, bank-bank menjelang

bangkrut seperti di Yunani sekarang. Yang terpikir pertama kali adalah

mengambil uangnya di bank. Sayangnya uang yang dimiliki bank jumlahnya tidak

cukup untuk memenuhi klaim nasabahnya karena sistem fractional reserve leanding. Jadi cash adalah asset yang pertama akan melambung ketika krisis debt deflation datang. Bukan emas.

TD: Jim, in your mind what does that

look like when the system begins to break down and gold behaves differently in

US dollar term price?

JR: Well, people like to criticize

the dollar and they say it’s not backed by anything and they will say the same

thing about bitcoin. Bitcoin is another form of money, another currency and they

go, “Well, I don’t like bitcoin because it’s not backed by anything.”

Well,

guess what. The dollar and bitcoin and all other forms of paper money or

digital money are backed by one thing, which is confidence. If people think

it’s money, it’s money. If you have confidence in the form of money, then it

has value.

So

right now the dollar and the bitcoin are backed by confidence but let’s talk

about the dollar in particular. The problem with confidence is it’s very

fragile. It can be lost very quickly and once you lose it, it’s very difficult

to regain and I don’t think the Fed understands that.

I

think the Fed takes the value of the dollar for granted. They assume that

confidence will always be there. They assume that they can print as much money

as they want, try to get as much inflation as they want and people won’t lose

confidence in the dollar and I think that’s analytically and historically

incorrect.

I

would say that for now, yes, confidence is being maintained. But in a complex

dynamic system, it’s a little bit like running a nuclear reactor. It can run

well for a long period of time. But if you push one wrong button, the whole

thing melts down catastrophically. You create a chain reaction and it melts

down out of control.

In

a complex dynamic system, it’s a little bit like running a nuclear reactor. It

can run well for a long period of time. But if you push one wrong button, the

whole thing melts down catastrophically.

It

happens very quickly and the same thing is true of the dollar. Some set of

circumstances, maybe something we can perceive, or something that we don’t

perceive. It’s often the thing that you don’t see coming that gets you. But

something could trigger this and the system is already unstable. It’s highly

unstable.

But

it’s chugging along. The confidence is being maintained. If it’s lost, it can

melt down very quickly and that’s where gold -- all of a sudden, boom! The day

will come and it may be up $200 an ounce in one day. Boom, the next day,

another $200 an ounce.

Then

people will be saying it’s a bubble, and it just starts to really go

hyperbolic. That’s when the panic sets in. That’s when confidence in paper

money is being lost as reflected in a higher dollar price for gold.

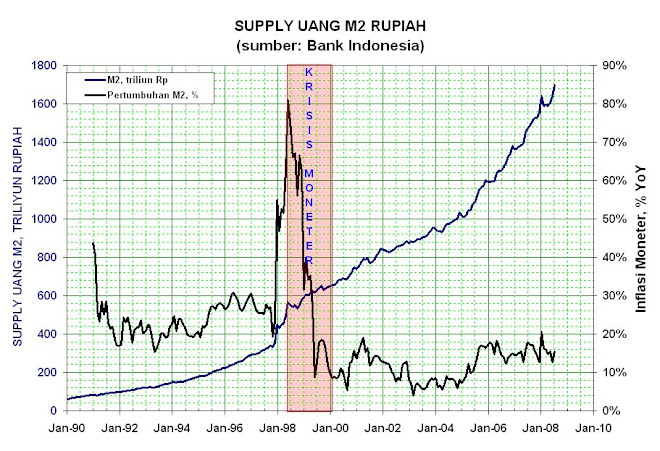

Komentar EOWI: Ketidak-percayaan terhadap

uang kertas akan terjadi dimasa inflationary

bukan deflationary. Nilai mata uang

melorot pada saat inflasi (jumlah uang yang beredar bertambah dengan cepat).

Pada saat itu kepercayaan terhadap uang kertas melorot. Tetapi ketika masa deflationary, uang yang beredar

mengalami kontraksi, atau stagnan, tidak ada alasan untuk takut nilai uang

kertas tersebut untuk melorot. Dan sebagai akibatnya, tidak alasan untuk

mencari alternatif lain sebagai safe

heaven.

At

that point, the talk on TV will still be saying it has no intrinsic value. But

it will have a life of its own and the price will go a lot higher. But at that

point, you might not be able to get it. You might find that all the weak hands

have already gotten rid of it. The strong hands are holding on to it, and you

will call your dealer or they will say, “Sorry, I’m out of stock,” or you call

them and they say, “We’re not making deliveries.”

Big

guys, people who deal in tons, may be able to get some of it but may not. The

unallocated gold holders, the LBMA contracts -- they’re going to call their

banks and say, “I want to allocate it. I want to take physical delivery.” The

banks are going to say, “Sorry, we don’t have it. We’re going to send you a

check for the price difference and terminate the contract.” People are going to

find that the paper claims are just papers. So my advice is well, again, what

are you waiting for?

Komentar EOWI: Seandainya ada fractional reserve lending di bank-bank

emas (tempat penyimpanan emas seperti Pert Mint), rasa panik para nasabah bank

pemilik emas harus dipicu dulu oleh

berita bahwa bank-bank emas sudah berlebihan dalam meminjamkan emas mereka.

Apakah dalam waktu dekat ini ada yang bisa

memicu ketidak percayaan para pemilik account emas sehingga mereka

berbondong-bondong menarik emasnya dari bank emas?

Sejarah mencatat, dimasa krisis moneter

banyak bank yang bangkrut, sehingga perlu menariki dana dari rekening seawal

mungkin. Untuk bank emas, krisis semacam apa yang bisa membuat bank emas tidak

likwid atau pailit?

Saya tidak tahu jawabannya. Mungkin juga

Jim Rickards.

Tekoa Da Silva: Jim, there’s

one more question I want to ask you, and then there’s a passage in your book

that you mentioned beforehand, that might be of interest to the reader.

What

have you found to be the risk and the importance of telling the truth when we

look at the political/economic stage globally?

Jim Rickards: Well, I would

start by saying truth has sort of a ring of absolute moral and scientific

certainty to it. So I try to do the best I can. I work hard. I do the analysis.

I read a lot. I travel a lot. I talk to a lot of people. I give people the best

analysis I can and I believe in it. I wouldn’t publish or say anything that I

didn’t personally believe in. So it’s the truth as far as I know, but I don’t

want to claim moral certitude.

But

I’ve spoken to members of the board of governors of the Fed, reserve bank

presidents, senior officials of the IMF, heads of state, and I’ve spoken to

Nobel Prize-winning economists.

I have

also spoken to Ben Bernanke recently in Korea one-on-one. We were in a

small group of about 10 of us, and had a nice conversation with the former

chairman, and what I find is that sometimes people will say things privately

that they won’t say publicly.

Part

of that has to do with institutional constraints. If a chairman says something

pretty candid about gold, it could start a panic so they’re very aware of their

institutional responsibilities. Other times, you feel like you’re in a club

where you say things in the club that you might not say elsewhere.

As

an example, I’m a writer, analyst, portfolio manager, and a public speaker.

I’ve got to call it like I see it, but that doesn’t mean I have a perfect

analysis or a perfect track record. But it does mean I’m working hard and

trying to convey to people exactly what I see.

But

I’m not a government official. I’m not the head of the IMF. I’m not on the

board of governors. I’m not the reserve bank president. So I don’t have some of

those responsibilities to avoid panicking people. What I’m trying to do is warn

people about some of the threats out there because that’s the world we live in.

So

there are a lot of dangers out there but I’ve never said be 100% in gold. When

gold goes down, people beat me up. They say, “Jim, you’re an idiot because you

said gold would go up.” But I never said 100% should be one’s allocation. I’ve

said 10% and I still say 10%. To me that’s the right amount.

If

you have 10% of your investable assets in gold, and gold goes down 20%, it’s

only a 2% portfolio loss because if you have a 20% decline on 10% of your

portfolio and everything else is even, your portfolio has only lost 2%. But if

I’m right and gold goes up by multiples that could be your insurance against

losses if everything else is melting down. So to me, if you don’t have gold in

your portfolio, it’s like not having fire insurance on your house. You better

hope your house doesn’t burn down.

If

you don’t have gold in your portfolio, it’s like not having fire insurance on

your house. You better hope your house doesn’t burn down.

Tekoa,

there’s one other thing I just want to follow up on -- from my book, The Death

of Money, because you’re in it. Readers who have read the book are familiar

with it; but for some of our readers who might not have read the book, you did

a fascinating Q&A with European Central Bank Chief Mario Draghi not that

long ago at Harvard

University. I commend you

for asking a tough question of the head of the European Central Bank. But his

answer was even more fascinating. I will just read parts of it quickly.

This

is a quote from Mario Draghi answering a question from you, Tekoa Da Silva,

where he says to you:

“You’re

asking about gold to someone who has been the governor of the Bank of Italy.

The Bank of Italy is the fourth largest owner of gold reserves in the world. I

never thought it wise to sell gold, because for central banks, this is a

reserve of safety. It is viewed by the country as such.”

In

other words, here’s Mario Draghi, the second most powerful central banker in

the world after Janet Yellen speaking to you, saying that gold is a reserve of

safety. You don’t hear a central banker speaking that way very often. But I

commend you for getting that quote and I was glad to be able to use it in my

book as part of a longer explanation of the role of gold in the International

Monetary System.

Tekoa Da Silva: Jim, I was

honored by you’re having added that in there, and I’m very grateful to have the

opportunity to be sitting down with you discussing it. Thank you very much.

Jim Rickards: Well, thank

you. You’ve spoken to Mario Draghi. I’ve spoken to Ben Bernanke. So hopefully

the readers will get a lot out of this interview because we’ve had some

firsthand interactions. Thank you.

Tekoa Da Silva: In winding

down, is there anything you think we may have missed?

Jim Rickards: I would say

-- I know a lot of gold investors are very discouraged right now. We explained

why the low dollar price of gold is just the inverse of the strong dollar. But

I expect the dollar to get weaker. But I did also have an interesting

conversation with Jim Rogers not long ago. Jim is a famous commodities trader,

stock investor and analyst, one of the best in the world. He invests in all

commodities and looks at emerging markets.

So

he has been around longer than I have and knows more about commodities than

anyone I know. But he made a very interesting observation. He said nothing goes

through a [full up-cycle] without a 50% retracement somewhere along the way. So

if you pick your base -- it could be $200 oz. gold or whatever you want (and I

see gold going to $5000, $7000, $10,000 an oz. by the way).

Komentar EOWI: EOWI juga melihat emas

akan ke level $5,000, $7,000 atau $10,000. Tetapi itu nanti 15 tahun lagi, pada

saat commodity secular bull market kembali menguasai pasar investasi.

Tetapi dalam 5 tahun ke depan? EOWI pikir,

emas akan ke level $600 akibat tekanan deflasi.

If

you want to go back to a gold standard or you have a global financial panic and

you need to restore confidence, that’s the price of gold you would need. That’s

where gold has to be in order to avoid deflation in a world where you’re using

any kind of gold standard. And that’s not a complicated equation. That’s kind

of eighth grade math that anyone can do.

So

let’s say gold is going to go from $200 oz. to $10,000 oz. or higher; what Jim

says is that it never goes there in a straight line. Somewhere along the way it

will go down 50%. So if you look at the August 2011 $1900 high, we’re down

about 50% percent from there.

That’s

the way commodities behave. But he also told me, “I’m not selling the gold I

have. I will buy more around the $1000 level. My expectation is that it will go

much, much higher from there, so there is no reason to be discouraged.”

So

it’s a long game, and I’m personally buying gold.

TD: Jim, how can our readers follow

your communications moving forward?

JR: Well my Twitter feed is very

active. It’s @JamesGRickards, and I have my books, The Death of Money and

Currency Wars. But I also have a newsletter, Rickards’ Strategic Intelligence.

Tekoa Da Silva: Jim Rickards

-- thank you so much for sharing your comments with us.

Jim Rickards: Thanks,

Tekoa.

Komentar EOWI: Menurut pandangan EOWI, sampai

5 tahun ke depan ekonomi global masih dalam periode deflasi. Kejayaan emas

masih harus menunggu 10 – 15 tahun lagi, ketika inflasi kembali. Untuk saat ini.....US

dollar cash adalah raja.

Sekian dulu semoga anda menikmati obrolan

Jim Rickards dan komentar EOWI. Jaga tabungan dan investasi serta kesehatan

anda baik-baik. Punya duit banyak akan percuma jika anda sakit-sakitan. Bahkan

jika anda sakit, duit anda akan terkuras habis dalam sekejap untuk pengobatan.

Disclaimer: Ekonomi (dan investasi) bukan sains dan tidak pernah dibuktikan secara eksperimen; tulisan ini dimaksudkan sebagai hiburan dan bukan sebagai anjuran berinvestasi oleh sebab itu penulis tidak bertanggung jawab atas segala kerugian yang diakibatkan karena mengikuti informasi dari tulisan ini. Akan tetapi jika anda beruntung karena penggunaan informasi di tulisan ini, EOWI dengan suka hati kalau anda mentraktir EOWI makan-makan.

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)